Introduction

In the last article, I introduced the difference between regular divergence and hidden divergence.

In this article, I would like to explain how to avoid deception of divergence.

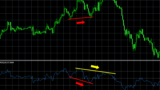

In the last article, I explained that regular divergence implies a trend reversal. However, as shown in the chart below, even regular divergence occur, price often does not go opposite direction and return to original direction as trend continuation. In such case, traders have to loss cut to avoid further loss.

Then how should we avoid the “fake” of divergence?

Judging “high probability” by not only the occurrence of divergence but also other factors

The most important point is not to enter only the occurrence of divergence. Considering other factors as well, we should only enter when it is judged that it is highly possible entry timing to win.

For example,

- Whether the trend is strong now and it is better to be trend follow, or is trend-less and counter trend is better

- What time zone is it now (Asia time, early European time, etc.)

- How is the currency strength (which currency is strong, and which one is week)?

- How is the positional relationship with moving average (SMA, EMA, GMMA etc.)?

- How about the status of the other oscillators?

After comprehensively considering multiple factors of own methods, we should make entry when we judge the timing is superior to win.

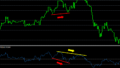

Watch whether to exceed last high or fall below last low

If (regular) divergence occurs at the end of the upward trend, the price once rises, but if it continues to fall again without being able to exceed last high, it will often lead to a real trend change.

If (regular) divergence occurs at the end of the downtrend, the price once falls, but if it continues to rise again without being able to fall below last low, it often leads to a real trend change.

If we apply above to hidden divergence.

If hidden divergence occurs in the middle of the upward trend, if price once fall, but it continues to rise again without being able to fall below last low, it often leads to a real trend continuation.

If a hidden divergence occurs at the middle of the downtrend, if price once rise, but if it continue to fall again without being able to exceed last high, it often leads to a real trend continuation.

Timely entry by shorter timeframe

Another important point is that even if we are based on 1-hour or 4-hour divergence, it is important to make timely entry by shorter time-frame chart such as M5 chart or M1 chart.

At the next article, I would like to write about “Why we delay being aware of occurrence of divergence?”