Introduction

This is the third article about divergence trade strategy.

We can easily find divergence by looking at past charts. But isn’t it hard to recognize the occurrence of divergence in the ongoing chart?

If we are too late to notice divergence and the chart has already passed the perfect reversal point or great point of buy on dip or sell on rally, we have to give up.

Why we delay being aware of occurrence of divergence?

So why we delay being aware of occurrence of divergence?

This is my experience, but I think it’s because we didn’t “predict and wait” for divergence.

It is often said that “waiting” is important in forex trading. However, it’s no good just sitting down in front of the chart, gazing at the monitor, and just waiting. (Except for those who like to look at charts all the time, and for scalpers.)

Both regular divergence or hidden divergence, we analyze charts and indicators that are likely to occur divergence and create scenarios.

You may consider how many hours later will divergence occur. For example, if you use the 1-hour chart, you may think “Let’s wait 5 or 6 bars in H1 chart until the European time”.

Sometimes it goes just same as the scenario, and sometimes it doesn’t. It is better to have multiple scenarios. For example,

- Scenario 1: A scenario that hidden divergence occurs, and the trend continues

- Scenario 2: A scenario that hidden divergence does not occur and the trend changes

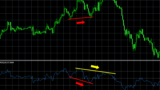

If you predict in this way, you can easily make entry when the price moves according to the scenario, and you can respond even if price moves away from multiple scenarios. The chart below is an example of scenario 1 and scenario 2 above.

Hidden divergence and regular divergence often occur continuously. In situations where we consider current trend is very strong and trend follow is advantageous based on market environmental, we may wait until the occurrence of hidden divergence after divergence. Conversely, in a market with weak trends, we may wait until the occurrence of regular divergence after the hidden divergence.