Introduction of “RCDG Hybrid Trading” strategy

I would like to introduce my original strategy called ”RCDG Hybrid Trading” using RSI, CCI, Divergence, and GMMA.

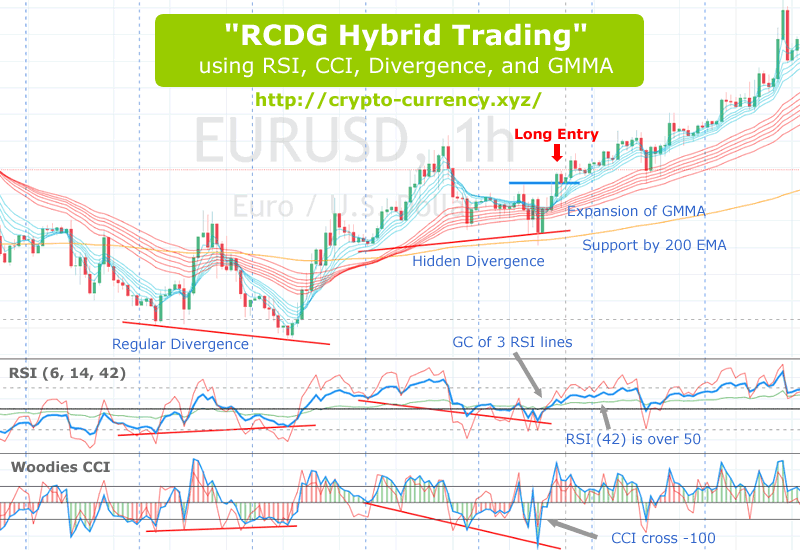

Please take a look at example chart below.

This strategy is possible for any currency pair, 1-hour chart is preferable.

Indicators are RSI (6, 14, and 42), Woodies CCI, GMMA, and 200 EMA.

The red arrow means entry point of Long. I evaluate possibility to win using multiple factors as follows.

- Occurrence of “Hidden Divergence” (or “Reversal”) which implies trend continuation (If it occurs after “Regular Divergence”, it is better.)

- Golden cross of 3 RSI lines

- Long term RSI (42) is over 50

- CCI cross -100 level (If CCI reach -200 before cross -100, it is better.)

- Expansion of GMMA

- Supported by 200 EMA

Basically this strategy means trend follow and besed on buy on dips. Not only those indicators, I evaluate market condition totally whether trend will continue.

Among the indicators, the most important factors are hidden divergence and CCI cross.

I make scenario of hidden divergence from Tokyo session, and wait a few hours for completion of hidden divergence in European session.