Trade Idea

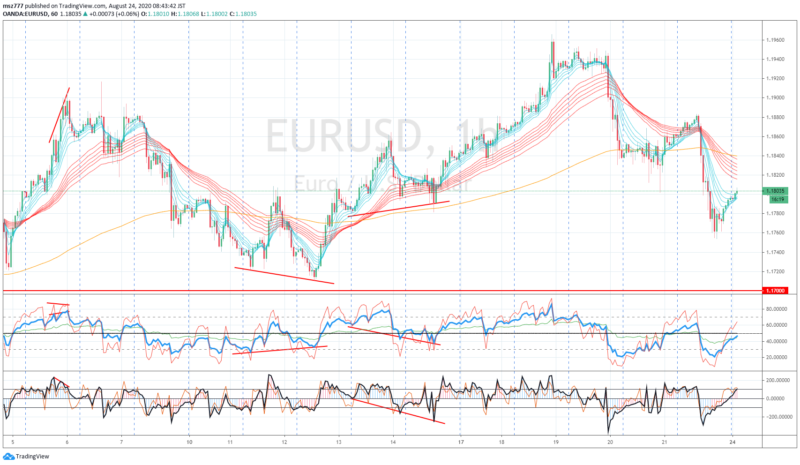

EURUSD H1

Good morning everyone. Today is Monday, and in this week, many traders in Europe and America take summer vacations.

Last Friday, European currencies (EUR and GBP) were sold in European time due to the worsening PMI figures and the difficulties of the UK-EU trade talks. In particular, GBP was heavily sold, temporarily fell to 1.306, and EURUSD fell to around 1.1754. In last week GBPUSD moved more than 170 pips up and down every day.

I didn’t take long position in US time the day before, so I took wait and see in European time without a position. After that, when the US time entered, the US long-term interest rate dropped to 0.636%, and USD selling pressure started. I bought EURUSD at 1.176 for mid-US time.

In this week the Jackson Hole Meeting will be held (Thursday-Friday).

Market Environment

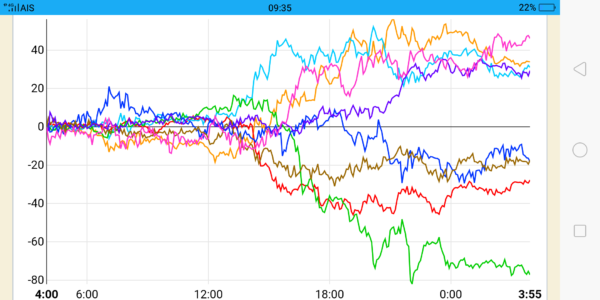

Yesterday (last Friday)’s currency strength

![]()

US market last night

Dow 30: 27,930 (+190, +0.69%)

S&P 500: 3,397(+0.34%)

Nasdaq: 11,311 (+0.42%)

WTI future: 42.30↓

VIX Index: 22.54↓

US 10 year bond yield: 0.636↓

Gold future: 1,947↓

Asian market today

Nikkei future: around 22,935(+45)

US Dow 30 future: around 27,928(+69)

Economic indicators today

GMT 22:45 Sunday(NZ)Retail sales – 2Q

8/27 (Thurs)-8/28 (Fri) Jackson Hole Meeting

(8/27 (Thurs.) GMT 13:10 FRB Mr. Powell Chairman’s lecture)

8/24 (Mon)-8/27 (Thu) American Republican National Convention

8/27 Speech by President Trump