Trade Idea

Good morning.

Yesterday’s USD was weak until the European market, but in the US market, the ISM Manufacturing report on business was strong, and the buyback strengthened. EURUSD suddenly rose to 1.1995 in Tokyo market, and temporarily set 1.20 in the early US market. After that EURUSD fell about 100 pips at around 1.1901 by profit-taking based on follow factors.

- Concerns about overbought EUR

- A sense of achievement of 1.20

- Mr. Lane ECB Chief Economist’s remark on the EURO’s high valuation

- Strong US ISM Manufacturing report on business

“The ECB is not targeting exchange rates, but EURUSD rate is a significant issue,” said Mr. Lane ECB Chief Economist. There is a caution that the ECB will continue to warn if EURUSD exceeds 1.20.

There was a sign of a sharp drop after hitting 1.20 for a moment at the beginning of the US market. After doing a few short trades in European time, after a plunge I entered small long at 1.190. EURUSD may have a heavy upside. But the “buy on dips” stance of EURUSD is unchanged for now.

EURUSD H1

Market Environment

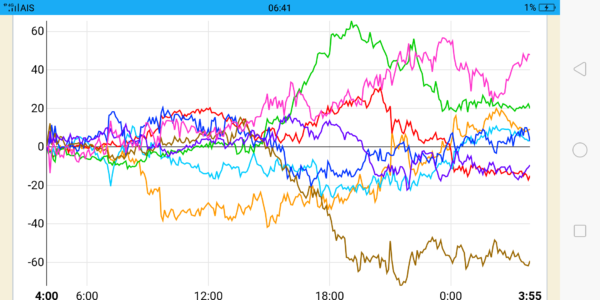

Yesterday’s currency strength

![]()

US market yesterday

Dow30: 28,645 (+215, +0.76%)

S&P500: 3,526 (+0.75%)

Nasdaq: 11,939 (+1.39%)

WTI future: 43.06↑

VIX index: 26.12↓

US 10- year bond yield: 0.675↓

Gold future: 1,977↑

Asian market today

Nikkei: around 23,257(+120)

Dow future:around 28,695(+50 Dow spot)

Economic indicators today

GMT 01:30 (AU) GDP (2Q)

GMT 12:15 (US) ADP report

GMT 13:00 (UK) BOE Mr. Bailey’s remark

9/3 (Thu) (US) New Jobless Claim, ISM index (Non-Mfg)

9/4 (Fri) (US) Non-Farm Payroll