Trade Idea

Good morning.

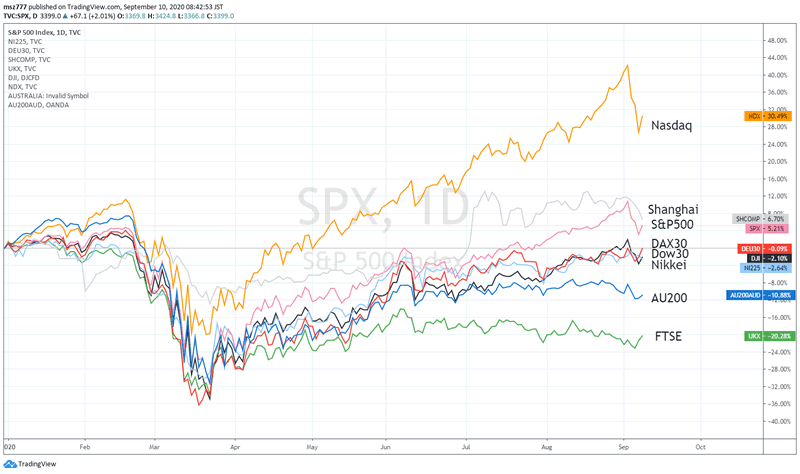

US stocks have rebounded for the first time in four business days. The repurchase of stocks mainly IT and high-tech sector, became dominant. Looking at how far US stocks have recovered, based on the daily closing prices for the year-to-date, it looks like the following. (It doesn’t seem like a big recovery.)

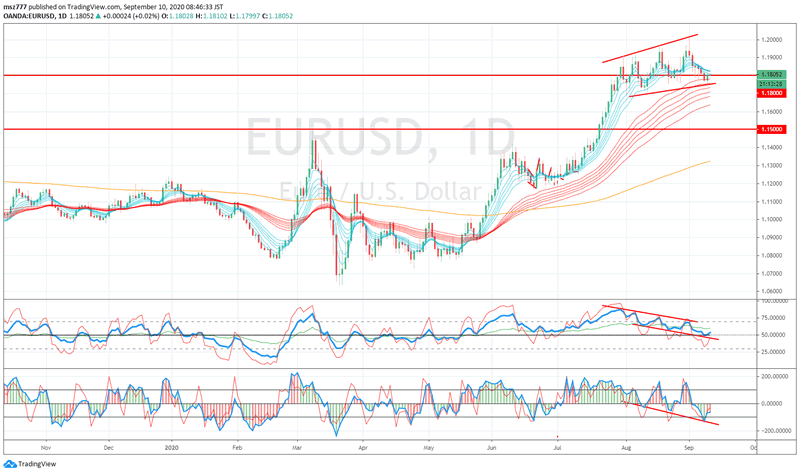

EURUSD temporarily fell to $ 1.1753 at the end of the European market, but USD was sold in response to the US stock rebound, and by the news of “some ECB officials have become more confident in the economic outlook.”, ECB’s additional easing possibility decreased, EUR buying became dominant and temporarily rose to 1.1834. However, in the latter half of US market, it become wait and see ahead of today’s ECB monetary policy.

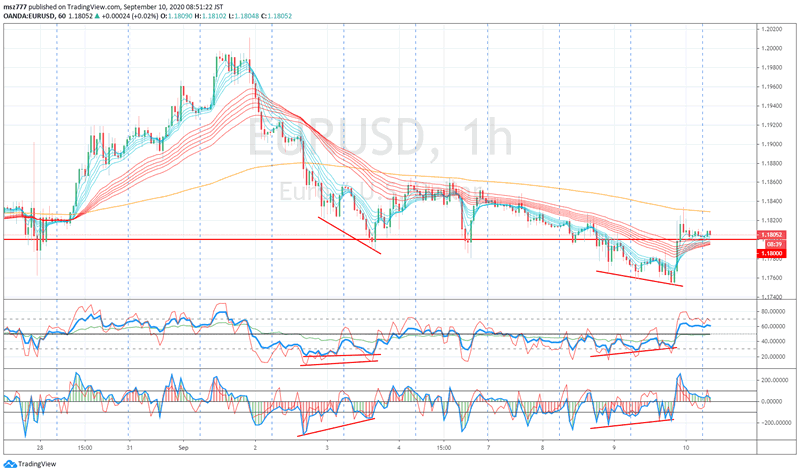

EURUSD looks like a bullish hidden divergence will be completed on daily chart, as yesterday’s my article. Hourly chart is also likely to be a bullish regular divergence (See the chart below). I’m waiting for the ECB results.

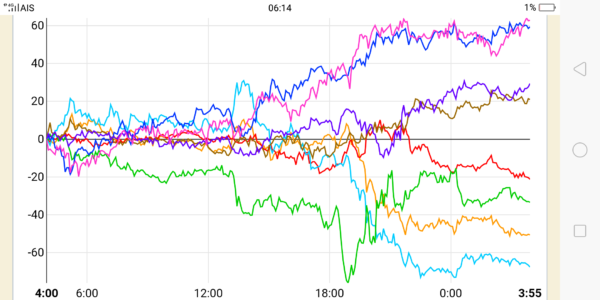

GBP is very weak anyway … On the other hand, the reversal of AUD is stronger than expected.

EURUSD D1

EURUSD H1

As well as D1 chart, H1 chart is becoming a good shape with bullish regular divergence.

Market Environment

Yesterday’s currency strength

![]()

US market yesterday

Dow30: 27,940 (+439, +1.60%)

S&P500: 3,398 (+2.01%)

Nasdaq: 11,141(+2.71%)

WTI future: 37.86↑

VIX index: 28.81↓

US 10 years bond yield: 0.698↑

Gold future: 1,955↑

Asian market today

Nikkei:around 23,220(+188)

Dow future:around 28,015(+74 Dow spot)

Economic indicators today

GMT 20:45(EU)ECB monetary policy

GMT 21:30(EU)ECB Ms.Lagarde press conference

GMT 21:30(US)New jobless claim