Trade Idea

Good morning.

EURUSD temporarily rose to 1.1917 as the ECB showed that it was not yet wary of current Euro level, saying it “does not need to overreact” with respect to Euro’s appreciation”. But EURUSD closed at around 1.1814, pushed by decline of the GBPUSD and profit-taking sales. It looks like EUR was dragged by the fall of GBP. It did not fall completely from the day before, but on a daily chart it became a small bullish candlestick with large upper shadow. GBP is in serious situation (see currency strength below). Yesterday GBPUSD fell 250 pips and GBPJPY fell 270 pips.

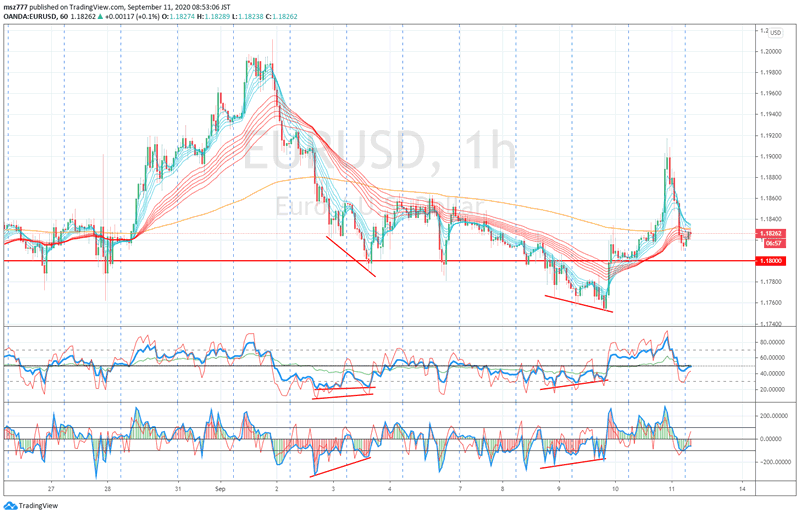

As in the article on the previous day and the day before, EURUSD became bullish hidden divergence on D1 chart and bullish normal divergence on H1 chart, but it fell 100 pips from yesterday’s high, so the adjustment is likely to continue. I will watch out GBP.

EURUSD D1

EURUSD H1

Market Environment

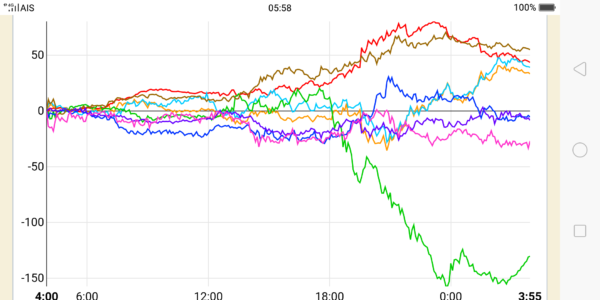

Yesterday’s currency strength

![]()

US market yesterday

Dow30: 27,534 (-405, -1.45%)

S&P500: 3,339 (-1.76%)

Nadaq: 10,919(-1.99%)

WTI future: 37.25↓

VIX index: 29.71↑

US 10 years bond yield: 0.682↓

Gold future: 1,952→

Asian market today

Nikkei:around 23,190(-42)

Dow future:around 28,500(-34 Dow spot)

Economic indicators today

GMT 06:00(UK)GDP, Trade balance

GMT 09:30(EU)ECB Ms.Lagarde remark

GMT 12:30(US)CPI