Trade Idea

Good morning.

After EURUSD rose to 1.1873 (per weekly pivot) in the European market last Friday, since ECB mentioned “no need to overreact” to the euro level, it was weakened ahead of next week’s FOMC. But adjustment was also limited, closing the week at 1.1846. Meanwhile, GBPUSD swung up and down 100 pips in European time due to concerns about hard Brexit.

As for EURUSD, it may be dragged by GBP and fall in short-term, but for the long-term upside trend unchanged and the buy on dips stance unchanged. Watch out for the movement of GBP.

A bird’s-eye view of the movements in the last month is as follows.

Transactions are concentrated in the 1.80-1.85 range.

Market Environment

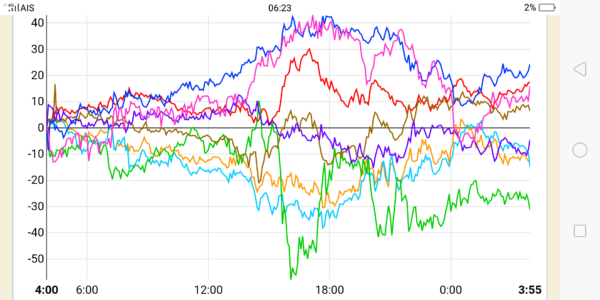

Yesterday’s currency strength

![]()

US market yesterday

Dow30: 27,665 (+131, +0.48%)

S&P500: 3,340 (+0.05%)

Nadaq: 10,853(-0.60%)

WTI future: 37.38↑

VIX index: 26.87↓

US 10 years bond yield: 0.669↓

Gold future: 1,948→

Asian market today

Nikkei:around 23,310 (-96)

Dow future:around 27,651 (-14 Dow spot)

Economic indicators today

(JP)LDP leader election

16 (Wed) FOMC policy

17 (Thu) BOJ policy

17 (Thu) BOE policy