Trade Idea

Good morning. There will be a FOMC policy announcement and press conference today.

EURUSD rose to 1.19 in the European market and has softened to 1.184 in the US market due to position adjustments ahead of today’s FOMC announcement and press conference. We can see “Cypher” pattern with resistance line of 1.19 and support line of weekly pivot. We also see bullish hidden divergence.

As for EURUSD, the short-term view may be effected by the FOMC and GBP, but the long-term uptrend remains unchanged and the buy on dips stance is unchanged. Keep an eye on FOMC and GBP.

[ Critical level of EURUSD ]

1.1900, 1.1911 (Fibo 0.618), 1.1925 (Weekly Pivot R1), 1.1955 (Fibo 0.786)

1.1839 (Weekly Pivot), 1.1800, 1.1770 (Weekly Pivot S1)

The most critical target is 1.1955 (Fibo 0.786: Harmonic Pattern – Gartley).

EURUSD H1

(Please click the chart to enlarge.)

For reference, EURUSD plummeted after last month’s FOMC summary (August 19th), so I’ll post the chart as follows. In the FOMC summary, the FRB clearly denied YCC (yield curve control) and it led to a reversal of US long-term interest rates and buyback of USD. EURUSD temporarily dropped by more than 100 pips to around 1.183.

(Please click the chart to enlarge.)

Market Environment

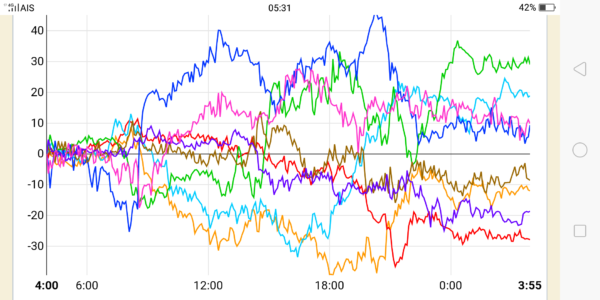

Yesterday’s currency strength

![]()

US market yesterday

Dow30: 27,995 (+2, +0.01%)

S&P500: 3,401 (+0.52%)

Nadaq: 11,190(+1.21%)

WTI future: 38.37↑

VIX index: 25.59↓

US 10 years bond yield: 0.681↑

Gold future: 1,962→

Asian market today

Nikkei:around 23,310 (-164)

Dow future:around 27,875 (-120 Dow spot)

Economic indicators today

GMT 22:45(NZ)Current account, 2Q

GMT 06:00 (UK)CPI, PPI

GMT 12:30(US)Retail sales

GMT 18:00(US)FOMC policy announcement

GMT 18:30(US)Mr. Powell Press conference

9-17 (Thu) BOJ policy

9-17 (Thu) MPC policy