Trade Idea

Good morning.

The FOMC result on the previous day was generally as expected with “zero interest rate deferred until 2023”, but at Tokyo market, USD repurchase continued with the interpretation that “there is no further easing of FRB”. But after that, the USD repurchase did not continue, and sell off became dominant in the US market and ended with a decline against most of the 10 major currencies. On the other hand, in the risk-off mood JPY was bought in whole day.

As for EURUSD, in Tokyo market it temporarily fell to 1.17375, but did not break 1.17 support and then rebounded, ending the US market at around 1.185. USDJPY has been selling predominantly from beginning to end, and JPY has strengthened to around 104.50, ending at around 104.70.

EURUSD has been rebounding on the weekly Pivot S1, but I would like to see if it goes up from here. I think there is a possibility of a lower price try again.

[ Critical level of EURUSD ]

1.1900, 1.1911 (Fibo 0.618), 1.1925 (Weekly Pivot R1), 1.1955 (Fibo 0.786)

1.1839 (Weekly Pivot), 1.1800, 1.1760 (Weekly Pivot S1)

EURUSD H1

(Please click the chart to enlarge.)

AUDJPY H1

(Please click the chart to enlarge.)

I made short position.

- Bearish hidden divergence (Reversal) on both RSI and CCI

- Heikin-ashi turned to red.

- RSI Dead cross

- CCI cross +100

- Below 200 EMA

- Below Weekly Pivot

- TP: Weekly Pivot (S1) 76.251, SL: 76.87

76.718 is a critical resistance line of AUDJPY as follows.

EURJPY H1

EURJPY is also critical level now. I made short position based on same conditions of AUDJPY.

Market Environment

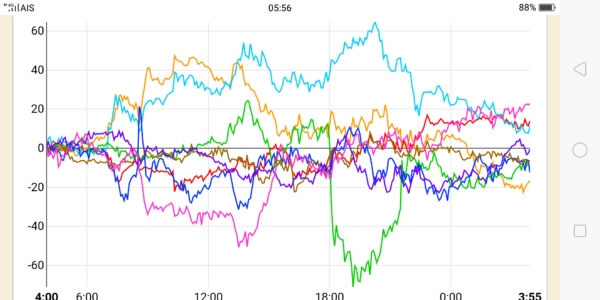

Yesterday’s currency strength

![]()

US market yesterday

S&P 500 3,357.01, -28.48 (-0.84%)

Dow 30 27,901.98, -130.40 (-0.47%)

Nasdaq 10,910.28, -140.19 (-1.27%)

Crude Oil 41.00, +0.03 (+0.07%)

Gold 1,953.80 +3.90 (+0.20%)

10-Yr Bond 0.6840, -0.0030 (-0.44%)

Asian market today

Nikkei:around 23,385 (+64)

Dow future:around 27,798 (-103 Dow spot)

Economic indicators today

GMT 06:00(UK)Retail sales

GMT 12:30(US)Current account, 2Q

GMT 12:30(CA)Retail sales

GMT 14:30(US)Michigan sentiment