Trade Idea

Good morning.

Yesterday, EURUSD, which continues to adjust its long position, temporarily fell to around 1.165 and ended around 1.166 as USD buying continued all day long. Signs of re-expansion of COVID-19 infection are seen not only in USA but also in Europe. USDJPY rose to 105.50.

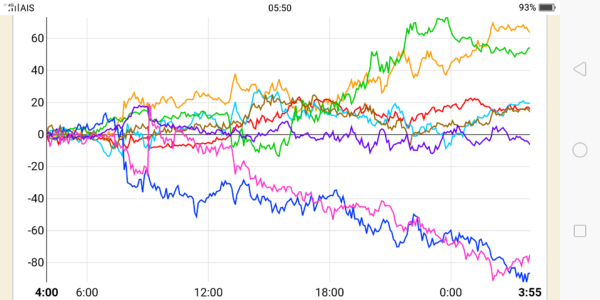

(See the currency strength below.) Only the Oceanian currencies AUD and NZD were sold all day, RBNZ has maintained the policy interest rate and quantitative easing as expected, and immediately after the announcement, NZD buying became dominant. However, it has fallen by more than 100 pips after that. AUDUSD, which was reported to have the next RBA rate cut by one of major Australian banks, has also dropped by more than 100 pips.

On the other hand, GBP was bought in an indescribable situation (when UK economy deteriorated, negotiations with the EU became flexible and GBP was bought …).

Since EURUSD fell below 1.17, I thought that it would plummet to 1.15 with a stop-loss, but it did not fall much. Below 1.16, the decline may accelerate. The Weekly Pivot (S3) is around 1.159. Anyway, US stocks and gold are going down, so I’d like to wait. We can see a lot of divergence on EURUSD chart below, but now there is no trades and no positions.

EURUSD H1

(Please click the chart to enlarge.)

Market Environment

Yesterday’s currency strength

![]()

US market yesterday

Dow30: 26,763(-525 -1.92%%)

S&P500: 3,236(-2.37%)

Nasdaq: 10,632(-3.02%)

10-Yr bond: 0.672 ↓

WTI Oil: 39.55 ↓

Gold: 1,861 ↓

Asian market today

Nikkei: 23,104~ (-206)

CME Dow future: 26,582~(-181 Dow)

Economic indicators today

GMT 22:45(NZ) Trade balance

GMT 07:30 (CH) SNB policy interest

GMT 08:00 (GE) IFO business climate index

GMT 12:30 (US) New jobless claim