Trade Idea

Good morning.

On last Friday, US stocks continued to rebound, but EURUSD temporarily fell to 1.1613, AUDUSD fell to 0.7006, the GBPUSD fell to 1.268, and USDJPY temporarily rose to 105.70, while risk-off USD buying continued.

EURUSD broke below 1.17 last Wednesday, so I expected if it would plummet to 1.15 with stop-losses, but it closed the week around 1.16315 without breaking 1.16 on Thursday and Friday. With the spread of the second wave of COVID-19 infection becoming larger in Europe, but EUR’s fall in September is still relatively modest compared to AUD and GBP.

I’m still waiting timing of EURUSD. Also I will pay attention to whether AUDUSD break below the 0.70.There is no position now.

EURUSD H1

Due to the wide price range in last week, this week’s Weekly Pivot S1 is far away and is around 1.1538.

(Please click the chart to enlarge.)

Market Environment

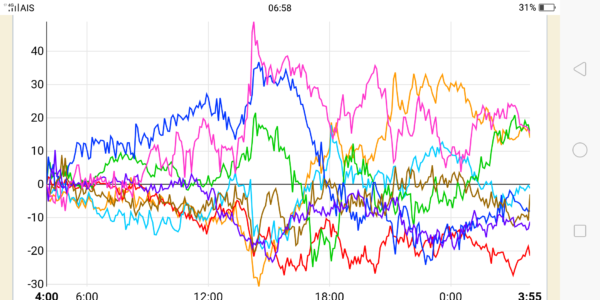

Yesterday’s currency strength

![]()

US market yesterday

Dow30: 27,173(+358, +1.34%)

S&P500: 3,298(+1.60%)

Nasdaq: 10,913(+2.26%)

10-Yr bond: 0.656 ↓

WTI Oil: 40.05 ↓

Gold: 1,864 →

Asian market today

Nikkei: 23,349~ (+145)

CME Dow future: 27,130~( -43 Dow)

Economic indicators today

No important economic indicators have been announced today.

29 (Tue) (US) Consumer Confidence Index

29 (Tue) (US) 1st debate of presidential candidate (The result will be revealed on the morning of 30th Tokyo market)

30 (Wed) (CH) Manufacturing PMI / Non-manufacturing PMI

30 (Wed) (US) ADP

1 (Thu) (JP) BOJ Tankan 3Q

1 (Thu) (US) ISM Manufacturing Index

1 (Thu) (US) New jobless claim

1 (Thu) (EU) EU Extraordinary Summit (~ 2 days)

2 (Fri) (US) NFP

6 (Tue) (AU) RBA policy rate