Trade Idea

Good morning.

Due to the sharp rebound of US stocks, forex market was dominated by risk-oriented USD selling, with EUEUSD temporarily rising to 1.168 and AUDUSD temporarily rising to 0.707. GBPUSD has risen sharply above 1.29. On the other hand, USDJPY was in range from 105.3 to 105.6 due to both USD-selling and JPY-selling.

This week we have presidential debate, end-of-month rebalancing, ISM and NFP, and market volatile is likely to be high. I would like to pay attention to whether adjustment movement from the beginning of September will be changed.

In addition, USD buying, which seems to be a rebalancing at the end of the month, was observed before 15:00 GMT.

Rebalancing of month-end USDJPY H1

(The point is blue vertical line. Please click the chart to enlarge.)

Rebalancing of month-end EURUSD H1

(The point is blue vertical line. Please click the chart to enlarge.)

Rebalancing of month-end AUDUSD H1

(The point is blue vertical line. Please click the chart to enlarge.)

Market Environment

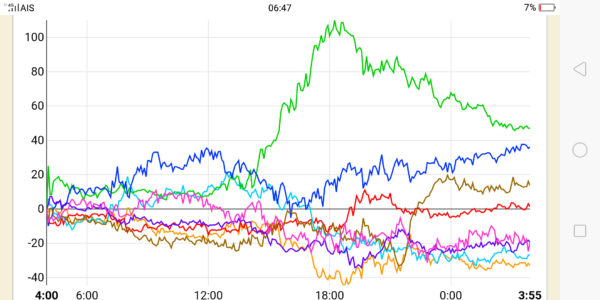

Yesterday’s currency strength

![]()

US market yesterday

Dow30: 27,584(+410, +1.51%)

S&P500: 3,359(+1.61%)

Nasdaq: 11,117(+1.87%)

10-Yr bond: 0.659 ↑

WTI Oil: 40.59 ↑

Gold: 1,891 ↑

Asian market today

Nikkei: 23,370~ (-142)

CME Dow future: 27,553~( -31 Dow)

Economic indicators today

GMT 14:00 (US) Consumer Confidence Index

29 (Tue) (US) 1st debate of presidential candidate (Morning AM10 of 30th Tokyo market)

30 (Wed) (CH) Manufacturing PMI / Non-manufacturing PMI

30 (Wed) (US) ADP

1 (Thu) (JP) BOJ Tankan 3Q

1 (Thu) (US) ISM Manufacturing Index

1 (Thu) (US) New jobless claim

1 (Thu) (EU) EU Extraordinary Summit (~ 2 days)

2 (Fri) (US) NFP

6 (Tue) (AU) RBA policy rate