Introduction

This time, we will introduce TLB (trend line break) pattern and HTLB (horizontal trend line break, horizon break) pattern as the last of the trend follow patterns.

Those patterns are easy to understand. Similar to drawing trend lines and horizontal lines on charts, TLB pattern draws trend lines on CCI lines, while HTLB method draws horizontal lines on CCI lines.

Example of TLB pattern and HTLB pattern

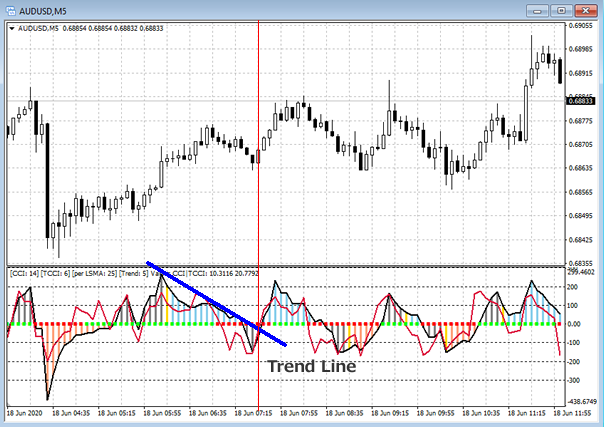

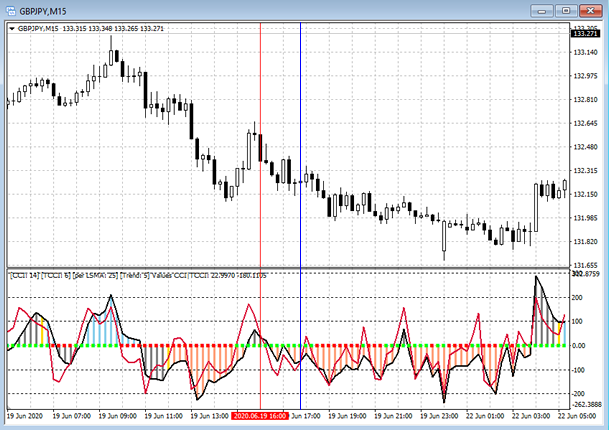

As an example of TLB pattern, please see chart below.

Entry timing is when the CCI line crosses the trend line (blue line) that connects the tops of the CCI line.

It is desirable to draw the trend line from a place as far as possible from the zero line (for example, over +/- 200 level).

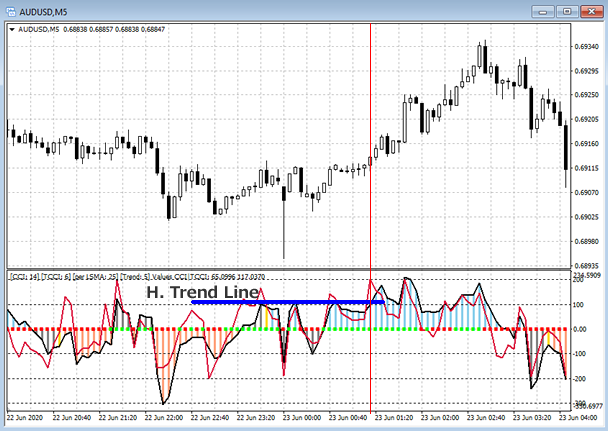

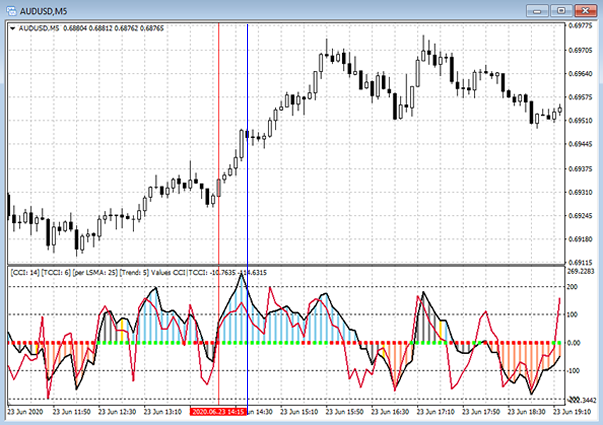

Also, I will introduce an example of HTLB pattern using horizontal line.

Please see chart below. I think this is less frequent than the TLB pattern using diagonal trend lines.

Both TLB pattern and HTLB pattern are “trend follow” pattern that enter in the same direction as the trend. In later article, I will introduce the “counter trend” TLB and HTLB pattern.

The method of drawing a trend line or horizontal line on an oscillator-based indicator is not limited to Woodies CCI, but is generally well introduced. Not only CCI but also other oscillators such as RSI can perform the same analysis.

According to the official commentary, it is possible to enter 20 seconds before the foot is confirmed, without waiting for the foot to be confirmed.

The timing of profit determination and loss cut will be explained in another article.

Exiting methods

So far, we have introduced four patterns for entry as trend follow (ZLR, RD, TLB, HTLB).

From the next article, we will introduce six patterns as entry as “counter-trend” which means entry in the opposite direction to the trend.

Before that, I will explain here how to exit in the Woodies CCI patterns. Regarding the exiting, the official reference mentions following methods.

- CCI hooking or going flat (*)

- CCI trend line break

- TCCI crossing into the CCI (*)

- CCI crossing the Zero Line

- CCI hook from extremes (HFE) (*)

- CCI not moving / no progress

- Profit about equal to hard-stop

- When the LSMA disagrees with the trade

The official reference specifically introduces three of them (* above).

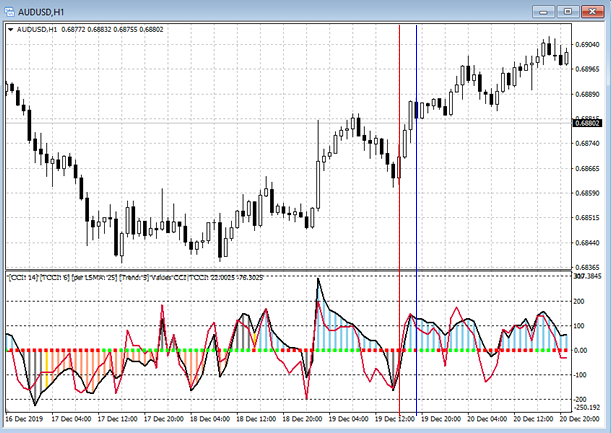

Example of exiting

Exiting by CCI hooking or going flat

The red vertical line shows the entry timing, and the blue vertical line shows the exiting timing.

Exiting by TCCI crossing into the CCI

The red vertical line shows the entry timing, and the blue vertical line shows the exiting timing.

Exiting by CCI hook from extremes (HFE)

The red vertical line shows the entry timing, and the blue vertical line shows the exiting timing.

In addition, “Hook from Extremes (HFE)” will be introduced as one of the patterns in later article. At this point, please recognize is as a reversal from the top of the over +/- 200 level.

You might think that all of the above examples are too early as exiting timing. It is also realistic to exit using moving averages or other technical indicators.

From the next article, I will introduce the “counter trend method” in which entries are made in the opposite direction of the trend.

My articles have the following structure.

Woodies CCI – Strategy Analysis (1) Basic

Woodies CCI – Strategy Analysis (2) ZLR trade pattern

Woodies CCI – Strategy Analysis (3) RD trade pattern

Woodies CCI – Strategy Analysis (4) TLB and HTLB trade pattern, Exiting

Woodies CCI – Strategy Analysis (5) Famir, Vegas, and Ghost trade pattern

Woodies CCI – Strategy Analysis (6) FFE, TLB, and HTLB trade pattern (counter trend)