Introduction

This is the final article about Woodies CCI strategy analysis.

First, I will introduce a pattern called “Fook from Extreme (FFE)” as one of counter trend patterns.

The purpose of this pattern is simple, and it is a method to focus the reversal timing from top or bottom.

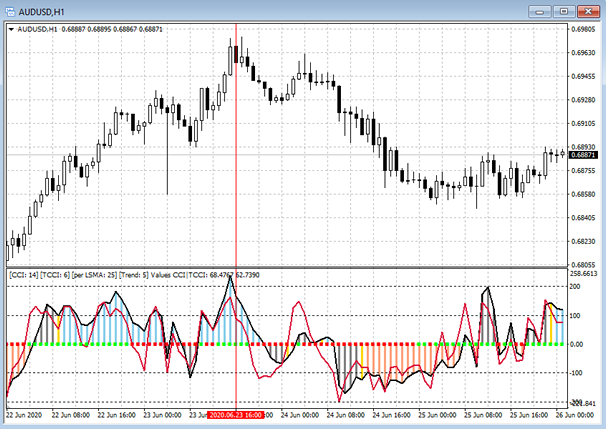

Example of FFE pattern

After CCI exceeds +/-200 level, red vertical line point means the entry timing as the reversal timing.

The official reference mentions that newbie traders should not use the FFE pattern. However, it also mentions that it can be used as a prior signal of other patterns.

Introduction of TLB and HTLB pattern (counter trend)

Finally, I will introduce the TLB pattern and HTLB pattern of counter trend methods to enter in the opposite direction to the trend.

This method is the same as the TLB pattern and HTLB pattern which was introduced in the 4th article, in the sense of aiming for trend line break. The difference is whether the entry is in the direction of the trend (trend follow) or the opposite direction to the trend (counter trend).

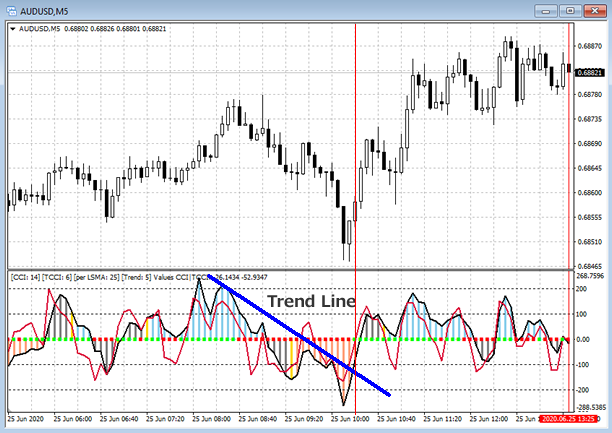

Example of TLB and HTLB pattern (counter trend)

Please see example chart of the TLB pattern (counter trend) as below.

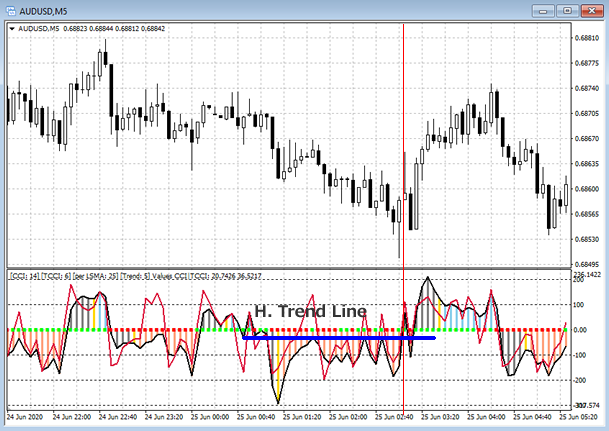

Next, please see example chart of the HTLB pattern (counter trend) as below.

Now, I conclude the Woodies CCI strategy analysis articles. It is no wonder that Woodies CCI is internationally popular and there are various derivative methods. In the future, I would like to step further and continue my research about Woodies CCI.

My articles have the following structure.

Woodies CCI – Strategy Analysis (1) Basic

Woodies CCI – Strategy Analysis (2) ZLR trade pattern

Woodies CCI – Strategy Analysis (3) RD trade pattern

Woodies CCI – Strategy Analysis (4) TLB and HTLB trade pattern, Exiting

Woodies CCI – Strategy Analysis (5) Famir, Vegas, and Ghost trade pattern

Woodies CCI – Strategy Analysis (6) FFE, TLB, and HTLB trade pattern (counter trend)