Trade Idea

Good morning.

It’s October from today. It’s about one month before the US presidential election. As for US presidential first debate, Mr. Biden was advantageous, and Chinese Yuan was bought.

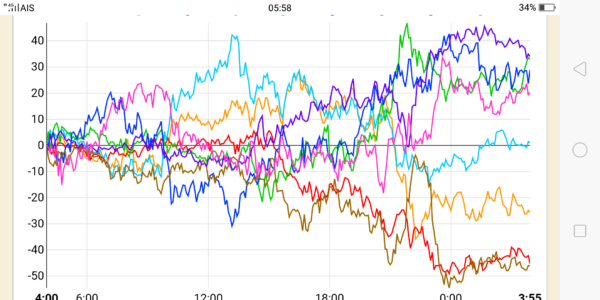

By the way, yesterday’s forex market was very difficult because it was irregular and undirected due to the rebalancing flow at the end of the month. As shown in the currency strength chart below, the strength order throughout the day was “AUD = GBP > JPY > USD > EUR.

EURUSD fell from the low 1.17 range to 1.1685 in the early US market, but was repurchased to 1.174 in London Fixing, and then fell to around 1.172 due to the fall of US stocks. USDJPY was in a narrow range of 105.40 – 80. On the other hand, AUDUSD and GBPUSD continued to buy, temporarily rising to 0.717 and 1.294, respectively.

EURUSD H1

(Please click the chart to enlarge.)

Market Environment

Yesterday’s currency strength

![]()

US market yesterday

Dow30: 27,781(+329, +1.20%)

S&P500: 3,363(+0.83%)

Nasdaq: 11,167(+0.74%)

10-Yr bond: 0.686 Up

WTI Oil: 40.00 Up

Gold: 1,893 Down

Asian market today

Nikkei: 23,185~ (-0)

CME Dow future: 27,749~( -32 Dow)

Economic indicators today

GMT 23:50 (JP) BOJ Tankan

GMT 12:30 (US) New jpbless claim

GMT 14:00 (US) ISM mfg index

2 (Fri) (US) NFP

6 (Tue) (AU) RBA policy rate