Trade Idea

Good morning. Today is Friday, we have Non-Firm Payroll in US.

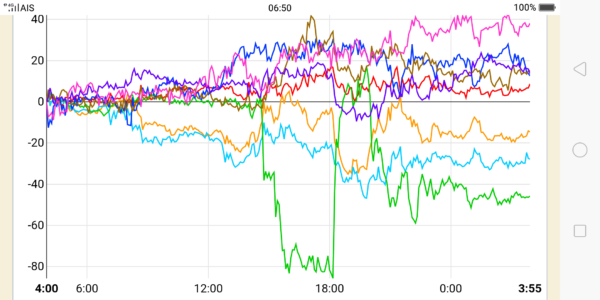

Yesterday’s foreign exchange market, like US stock market, has a strong wait-and-see attitude in discussions of US economic measure, mainly selling USD and JPY (please see currency strength chart below). EURUSD temporarily rose to 1.1768 and ended around 1.1745 in US market. USDJPY was in a narrow range 105.40-70.

Meanwhile, GBPUSD fluctuated at the headline of EU trade negotiations, dropping to 1.282 in the European market, then jumping to 1.297 in the early US market, and then rebounding to end at around 1.289. GBP is useless to trade at the final stage of Brexit.

Today we have US employment statistics, so I think it’s basically a wait-and-see. However, there are many candidates of bearish regular divergence for next week. (Example: AUDJPY and other cross JPY, AUDUSD, etc. In Australia, we will have RBA policy interest rate next Tuesday.)

EURUSD H1

(Please click the chart to enlarge.)

AUDJPY H1

(Please click the chart to enlarge.)

Market Environment

Yesterday’s currency strength

![]()

US market yesterday

Dow30: 27,816(+35, +0.13%)

S&P500: 3,380(+0.53%)

Nasdaq: 11,326(+1.42%)

10-Yr bond: 0.682 Down

WTI Oil: 38.48 Down

Gold: 1,909 Up

Asian market today

Nikkei: 23,308~ (+123)

CME Dow future: 27,708~( -108 Dow)

Economic indicators today

GMT 01:30 (AU) Retail sales

GMT 12:30 (US) NFP

6 (Tue) (AU) RBA policy rate