Trade Idea

Good morning.

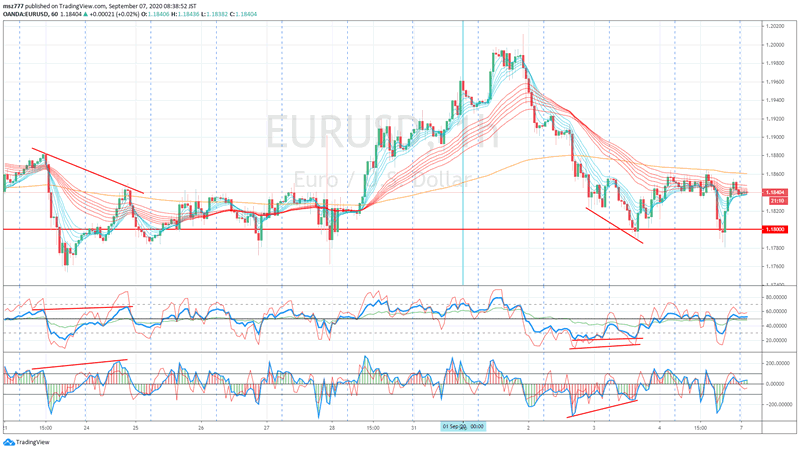

Last Friday’s employment statistics was improved, especially unemployment rate was greatly improved above the expectations. EURUSD once fell to 1.178, but then quickly bought back and closed the week at 1.1838. The risk currencies GBPUSD and AUDUSD also fell to around 1.318 and 0.722, respectively, and then ended the week at 1.328 and 0.728.

Last week’s USD repurchase continued from Tuesday. To summarize, USD weakened until Tuesday’s European market, temporarily reached 1.20 at the beginning of the US market, but after that, the US market turned around and buyback of USD strengthened based on factors as follows.

- Concerns about excessive overbought of Euro

- A feeling of achievement of 1.20

- Mr. Lane ECB Chief Economist’s remark on the Euro’s high valuation

- Strong US ISM Index

EURUSD fell by about 100 pips at around 1.1901 on Tuesday. And it fell by 80 pips on Wednesday, and by 30 pips on Thursday, in total 210 pips in 3 days. However, on Thursday and Friday it ended as same level as the day before. In European time on Thursday, we saw bullish regular divergence which implies trend reversal.

On Friday, EURUSD continued to test 1.17 same as the day before, following strong employment statistics, but continued pushing back to 1.18 same as the day before.

The selling pressure of EURUSD seems to be almost over. The red vertical line below is 1.18. The buy on dips stance of EURUSD remains unchanged. AUDUSD and GBPUSD will continue to depend on US stocks.

EURUSD H1

Market Environment

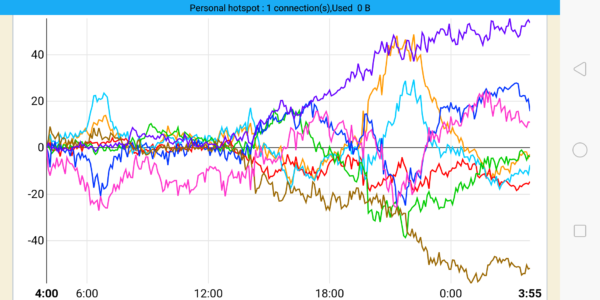

Yesterday’s currency strength

![]()

US market yesterday

Dow30: 28,292 (-807, -2.78%)

S&P500: 3,455 (-3.51%)

Nasdaq: 11,458 (-4.96%)

WTI future: 41.09↓

VIX index: 33.60↑

US 10- year bond yield: 0.636↓

Gold future: 1,939↓

Asian market today

Nikkei:around 23,205(-260)

Dow future:around 28,129(-4 Dow spot)

Economic indicators today

No important economic indicators will be announced today.

US market will be closed today (Labor Day holiday)

9/10 (Thu) ECB monetary policy