Trade Idea

Good morning.

US stocks fell sharply by the news President Trump will suspend talks on additional economic measures until after the presidential election.

In response to the stock market, the foreign exchange market also rapidly became risk-off mood at the end of US market. EURUSD temporarily surpassed the 1.18 level in the European market, but stalled in the US market, ending at 1.173. GBP also fell to around 1.287. USDJPY was in a narrow range of 105.50-70. AUD, RBA policy rate was left unchanged, rose to 0.7209 in the Tokyo market immediately after the policy was announced and then went back, and then plummeted to 0.71 at the end of the U.S. market, with a daily price range of 100 pips. ..

Recently, divergence occurs frequently in major currency pairs. Most are regular divergence (rather than hidden divergence) (as well as the EURUSD and AUDJPY below). In other words, there is no clear trend recently, and inversions occur frequently within a specific price range, so divergence usually occurs a lot. As the risk-off trend has become stronger, as I wrote it yesterday, I would like to pay close attention to the bearish regular divergence, focusing on the short of the cross JPY.

EURUSD H1

(Please click the chart to enlarge.)

AUDJPY H1

(Please click the chart to enlarge.)

Market Environment

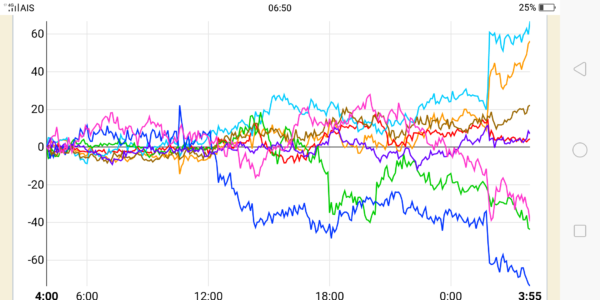

Yesterday’s currency strength

![]()

US market yesterday

DJIA: 27,772.76 (-375.88 -1.34%)

NASDAQ: 11,154.6 (-177.88 -1.57%)

S&P 500: 3,360.95 (-47.68 -1.4%)

GOLD: 1,882.7 (-26.1)

OIL: 39.78 (-0.89)

US 10-YR: 0.74 (+0)

VIX: 29.48 (+1.52)

Asian market today

Nikkei: 23,318~ (-115)

CME Dow future: 27,643~( -129 Dow)

Economic indicators today

GMT 16:00 (US) FOMC minutes(9/15-16)

8 (Thu) (EU) ECB minutes