Trade Idea

Good morning.

Yesterday, US stocks rebounded sharply, by expectations for an agreement on additional economic measures in the US, and the news that President Trump was discharged due to mild infection of COVID-19.

The foreign exchange market also started at the beginning of the week with “Risk-on” mood, JPY and USD depreciation. EURUSD temporarily rose to 1.1797 and closed the US market with 1.178. AUD and GBP also had a buying advantage from beginning to end. On the other hand, USDJPY temporarily rose to 105.79 and closed the US market around 105.7 due to the unwinding from the sharp risk-off selling last Friday.

Surprisingly, this week started with risk-on. It will be interesting to see if the EURUSD exceeds 1.18. However, CCI of H1 chart shows bearish regular divergence. Today we will have an announcing the Australian RBA policy rate.

EURUSD H1

(Please click the chart to enlarge.)

USDJPY H1

(Please click the chart to enlarge.)

Market Environment

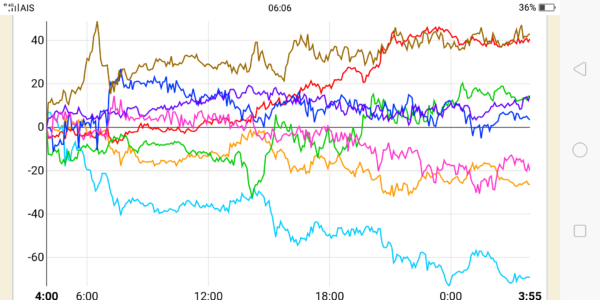

Yesterday’s currency strength

![]()

US market yesterday

DJIA: 28,148.64 (+465.83, +1.68%)

NASDAQ: 11,332.49 (+257.47, +2.32%)

S&P 500: 3,408.63 (+60.19, +1.8%)

GOLD: 1,918.6 (-1.5)

OIL: 39.3 (+0.08)

US 10-YR: 0.775 (+0.013)

VIX: 27.96 (+0.33)

Asian market today

Nikkei: 23,406~ (+94)

CME Dow future: 28,015~( -133 Dow)

Economic indicators today

GMT 03:30 (AU) RBA policy interest

7 (Wed) (US) FOMC minutes(9/15-16)

8 (Thu) (EU) ECB minutes