Trade Idea

Good morning.

Yesterday’s US stocks fell sharply for the third consecutive business day after holidays, continued to sell mainly to IT and high-tech stocks, and Nasdaq fell -4.11%.

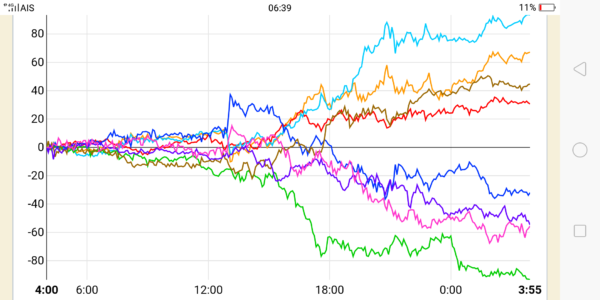

As you can see from the currency strength chart below, it is in typical risk-off mood in response to the stock market fall. Safe currencies were bought and risk currencies were sold. GBP has fallen sharply, with GBPUSD falling to 1.197 and GBPJPY to 137.50.

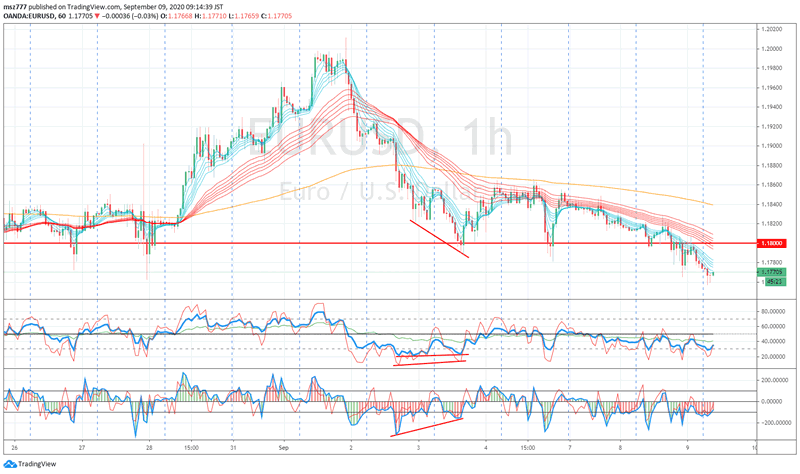

EUR was not sold too much, but USD was stronger. EURUSD temporarily fell to 1.1765 and closed around 1.1773. Although EURUSD is reluctant to lower it, I am waiting to see if the risk of stock prices continuing to fall off. There will be an ECB monetary policy announcement tomorrow.

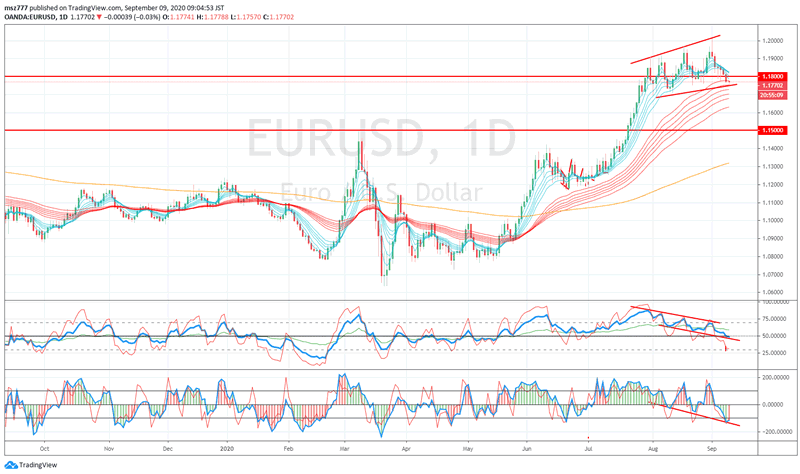

On a daily basis, EURUSD seems that bullish hidden divergence will come soon.

EURUSD D1

EURUSD H1

Market Environment

Yesterday’s currency strength

![]()

US market yesterday

Dow30: 27,500 (-632, -2.25%)

S&P500: 3,331 (-2.78%)

Nasdaq: 10,847 (-4.11%)

WTI future: 36.43↓

VIX index: 31.46↑

US 10 years bond yield: 0.664↓

Gold future: 1,936↓

Asian market today

Nikkei:around 22,956(-315)

Dow future:around 27,422(-78 Dow spot)

Economic indicators today

GMT 01:30(China)CPI, PPI

GMT 14:00(Canada)BOC monetary policy

9/10 (Thu) ECB monetary policy