Trade Idea

Good morning. While US stocks continued to recover sharply due to expectations for vaccine development, EURUSD rose to 1.1887 ahead of tomorrow’s FOMC, ending the US market at around 1.1865. As for EURUSD, the short-term view may be affected by GBP, but as the long-term view, uptrend remains unchanged and the buy on dips stance is unchanged. I will keep an eye on the movement of GBP. If US stocks return to uptrend, AUD will be another choice for long.

[ Critical level of EURUSD ]

1.1900, 1.1911 (Fibo 0.618), 1.1925 (Weekly Pivot R1), 1.1955 (Fibo 0.786)

1.1839 (Weekly Pivot), 1.1800, 1.1770 (Weekly Pivot S1)

The most critical target is 1.1955 (Fibo 0.786: Harmonic Pattern – Gartley).

EURUSD H1

(Please click the chart to enlarge)

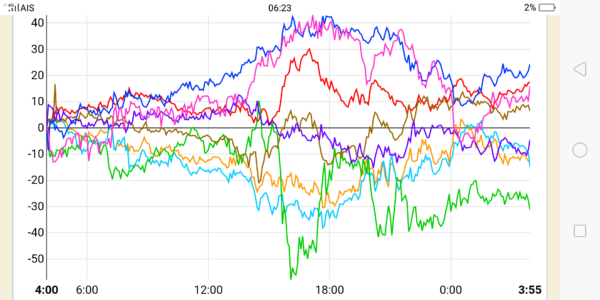

Market Environment

Yesterday’s currency strength

![]()

US market yesterday

Dow30: 27,993 (+327, +1.18%)

S&P500: 3,383 (+1.27%)

Nadaq: 11,056(+1.87%)

WTI future: 37.30→

VIX index: 25.85↓

US 10 years bond yield: 0.676↑

Gold future: 1,965↑

Asian market today

Nikkei:around 23,460 (-98)

Dow future:around 27,873 (-120 Dow spot)

Economic indicators today

GMT 01:30 (Australia)RBA minutes

GMT 02:00 (Chna)Industrial production, Retail sales

GMT 06:00 (UK)Jobless rate

GMT 09:00 (Germany)ZEW

16 (Wed) FOMC policy

17 (Thu) BOJ policy

17 (Thu) BOE policy