Trade Idea

Good morning. Last Friday, there was a lot of turmoil over President Trump’s infection.

The currency strength throughout the day was “GBP> JPY> USD> EUR=AUD“, which was a typical risk-off currency correlation except for GBP. EURUSD temporarily broke below 1.17 in the Tokyo market, but President Trump’s symptom was reported to be “mild” and it was in the range from 1.17 to 1.174 in London and US market. USDJPY also broke 105 level at Tokyo market, but reluctantly fell in London and US markets and rose to 105.40, closing the week at around 105.32. Cross yen such as AUDJPY and EURJPY were also lowered and finished. GBP had a buying advantage due to trade negotiation headlines, ending around 1.2935.

As for the US employment statistics, the NFP was +660,000, which was lower than expected, but the previous data was revised upward, and the unemployment rate was 7.9%, which was lower than 8%. Therefore, it did not affect negative impact.

EURUSD H1

(Please click the chart to enlarge.)

Market Environment

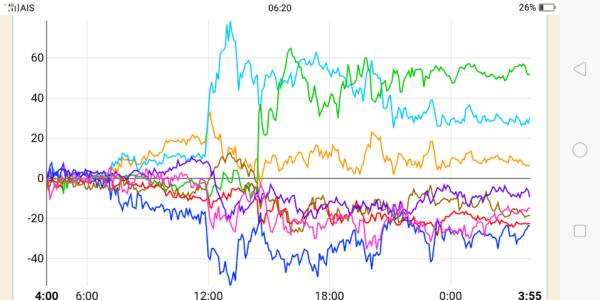

Yesterday (last Friday)’s currency strength

![]()

US market yesterday (last Friday)

DJIA: 27,682.81, -134.09, -0.48%

NASDAQ: 11,075.02, -251.49, -2.22%

S&P 500: 3,348.44, -32.36, -0.96%

GOLD: 1,904.1, -12.2

US OIL: 37.01, -1.71

US 10-YR: 0.704, +0.027

VIX: 27.63, +0.93

Asian market today

Nikkei: 223,352~ (+322)

CME Dow future: 27,775~( +92 Dow)

Economic indicators today

GMT 01:30 (AU) Retail sales

GMT 12:30 (US) NFP

6 (Tue) (AU) RBA policy rate