Trade Idea

Good morning.

Yesterday’s US stocks continued to rise for four days in all three indices. In US, the stock market was open, but with few participants on holidays, JPY buying and USD buying became dominant.

EURUSD temporarily fell to 1.178 weekly pivots and was repurchased to finish around 1.181. GBPUSD fell to 1.3007, but rebounded without breaking below 1.30 and closed the US market around 1.3067. USDJPY was sold to 105.24 on the weekly pivot, ending below the daily 20MA.

Before opening of Tokyo market, Chinese Yuan plunged (USDCHY soared) due to report that “People’s Bank of China (PBC) will cut costs for Yuan short to curb Yuan appreciation.” According to the statement from the PBC, financial institutions will not need to deposit 20% reserve when buying foreign currency for customers through foreign exchange forwards from the 12th of this month. When PBC also lowered its reserve requirement to zero in Sep 2017, Yuan fell about 2.5% in the next three weeks. The yuan has been appreciating recently, but it is highly likely that Yuan will retreat for the time being due to this measure.

[Status of Daily 20MA]

- Currencies stronger than Daily 20MA (against USD): EUR, NZD, AUD, GBP, CHF, CAD, CHY, JPY

- Currencies weaker than Daily 20MA (against USD): n/a

Yesterday JPY crossed Daily 20MA.

[Status of Daily Bollinger Band]

EURUSD: Parallel transition (reaching +1σ, retreated to weekly pivot)

GBPUSD: Expansion first move (exceeded + 2σ) and exceeded 1.30 resistance

AUDUSD: Parallel transition, slightly downward (3 consecutive bullish candles, not reached +1σ yet, retreated 20MA & 200EMA)

NZDUSD: Parallel transition (long bullish candle, not reached +1σ yet, retreated 20MA & 200EMA)

USDCHF: Parallel transition (reached +1σ)

USDCAD: Parallel transition (reached -2σ with 3 consecutive bearish candles, slightly repurchased)

USDJPY: Parallel transition with a slight contraction (fell below 20MA)

CADJPY: Parallel transition with contraction (reached +2σ with 3 consecutive bullish candles, and retreated)

USDCHY: Parallel transition, downward (exceeded -2σ, but soared to near 20MA by PBC announcement)

GBPUSD H1 (Please click the chart to enlarge.)

USDCHY H1 (Please click the chart to enlarge.)

Market Environment

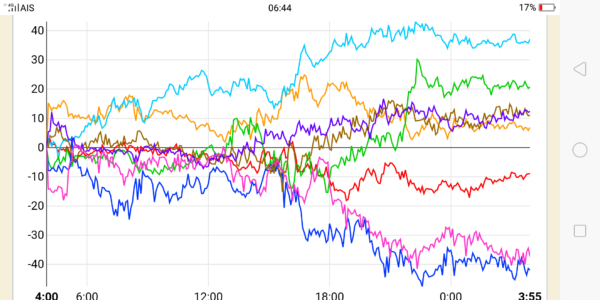

Yesterday’s currency strength

![]()

US market yesterday

DJIA: 28,837.52 (+250.62, +0.88%)

NASDAQ: 11,876.26 (+296.32, +2.56%)

S&P 500: 3,534.22 (+57.09, +1.64%)

GOLD: 1,928.8 (-0.1)

OIL: 39.56 (+0.13)

US 10-YR: 0.765 (-0.01)

VIX: 25.07 (+0.07)

Asian market today

Nikkei: 23,591~ (+32)

CME Dow future: 28,730~( -107 Dow)

Economic indicators today

GMT 09:00 (GE) ZEW Economic sentiment index

GMT 12:30 (US) CPI