Trade Idea

Good morning.

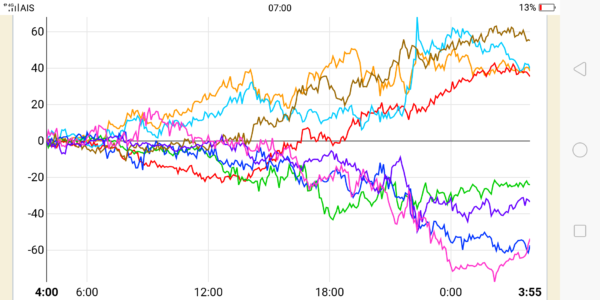

US stocks plummeted yesterday. Looking ahead to today’s US NFP, a sharp fall in US stocks, where the dollar continued to be bought back the day before, resulted in the purchase of “safe-heaven” JPY and CHF, and the sale of AUD, NZD, and GBP. Please currency strength chart below. You can see that yesterday was a day that was clearly divided into two groups: safe heaven currencies that are bought for risk-off mood and currencies that favor risk (currencies that are relatively vulnerable among G10 currencies).

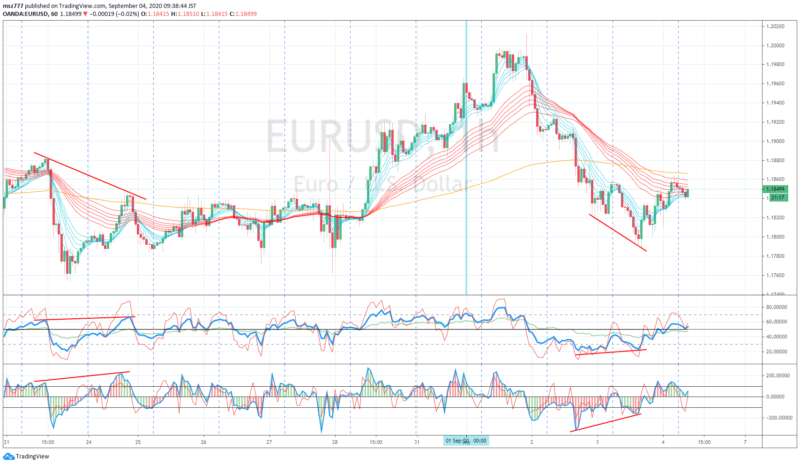

Yesterday, EURUSD fell temporarily to around 1.1789 in European time, was bought back in US time, and ended the US market at around 1.185.

As USD buyback from Tuesday this week has continued, on Tuesday EURUSD weakened to the European market and temporarily held 1.20 units in the early US market, but after that, the US market turned around and USD of buyback strengthened based on factors as follows.

- Concerns about excessive overbought of Euro

- A feeling of achievement of 1.20

- Mr. Lane ECB Chief Economist’s remark on the Euro’s high valuation

- Strong US ISM Index

EURUSD fell by about 100 pips at around 1.1901 on Tuesday. And it fell by 80 pips on Wednesday, and by 30 pips yesterday (Thursday), and 210 pips in 3 days. However, yesterday it ended as same level as the day before. In European time, we saw bullish regular divergence which implies trend reversal.

Buy on dips stance of EURUSD remains unchanged. Both AUD and GBP depend on US stock. I will wait for US employment statistics today.

EURUSD H1

Market Environment

Yesterday’s currency strength

![]()

US market yesterday

Dow30: 28,292 (-807, -2.78%)

S&P500: 3,455 (-3.51%)

Nasdaq: 11,458 (-4.96%)

WTI future: 41.09↓

VIX index: 33.60↑

US 10- year bond yield: 0.636↓

Gold future: 1,939↓

Asian market today

Nikkei:around 23,130(-335)

Dow future:around 28,164(-128 Dow spot)

Economic indicators today

GMT 01:30(AU)Retail sales

GMT 12:30(US)NFP

US market will be closed on next Monday (Labor Day holiday)