Introduction

In each country, there is a correlation between the yield of government bonds, stock market, and foreign exchange rate, but in the case of the Euro, the major feature is that the yield of related government bonds is not limited to one government bond. In this article, I would like to compare the trend in the yield spread between German and Italian 10-year government bonds and the movement of the Euro.

Germany/Italy 10-year government bond yield spread and Euro

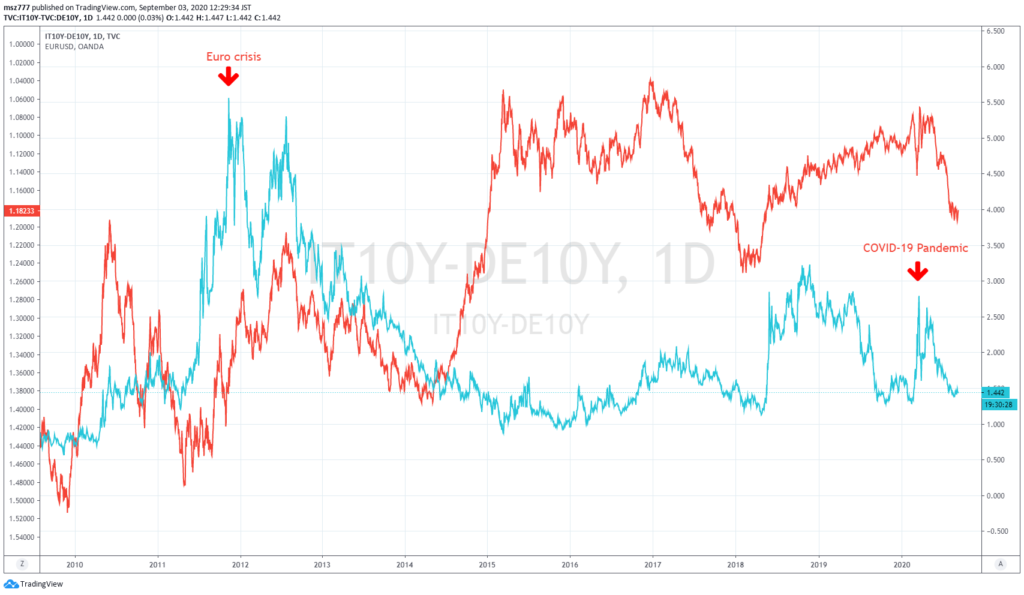

The chart above is a long-term comparison of 10-year government bond yield spread between Germany and Italy and the EURUSD (upside down) over the decade since 2010.

The blue line is the yield spread between German and Italian 10-year government bonds (the scale is on the right), and the red line is the EURUSD (but upside down; the scale is on the left.).

Two red arrows are shown for the 10-year government bond yield spread between Germany and Italy on the blue line. The arrow on the left is the 2011 Euro crisis (yield spread: above 5.5%) and the arrow on the right is this year’s COVID-19 pandemic shock (yield spread: 2.8%).

As you can see from the 10-year long-term chart above, there is a strong correlation between the German-Italy bond yield spread and EURUSD (the opposite correlation). The ECB’s strengthening of monetary easing was a major turning point in May 2014, and the Eurodollar has fallen sharply thereafter. (The chart above is inverted, so it goes up)

Due to the situation in Italy, where the spread of the new COVID-19 has become more serious, the yield spread on 10-year government bonds between the two countries widened to a maximum of 2.8% on March 17, 2020. But since then, the bond yield spread has subsided and EURUSD has soared.