Trade Idea

Good morning.

Appreciating of JPY is ongoing. In the European and US markets last Friday, buying of risk-off JPY became dominant. USDJPY has declined for 5 consecutive days, temporarily declining to 104.28, and closing the week at around 104.57.

EURUSD, on the other hand, was trading in a narrow range and closing weekly at around 1.184. Last week, in Asian time after the FOMC, it fell to around 1.174 with the interpretation that “There is no further easing of FRB”, but USD repurchase did not continue and it returned to 1.18 soon. There is no clear sign of trying 1.20, which is a big milestone, but the downside remains firm. The range from 1.18 to 1.19 may continue.

Since buying of JPY became dominant, the cross JPY fell sharply. EURJPY fell to 123.50, and AUDJPY fell to below 76 temporally.

EURUSD rebounded last week on the weekly Pivot S1 and it still in a range of 1.18 to 1.19. I would like to see if the cross-JPY will try further downwards on Monday and Tuesday (Japanese holiday).

EURUSD H1

(Please click the chart to enlarge.)

EURJPY H1

(Please click the chart to enlarge.)

AUDJPY H1

(Please click the chart to enlarge.)

Market Environment

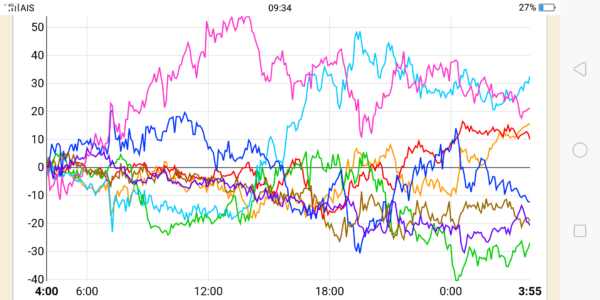

Yesterday’s currency strength

![]()

US market yesterday

S&P 500 3,357.01, -28.48 (-0.84%)

Dow 30 27,901.98, -130.40 (-0.47%)

Nasdaq 10,910.28, -140.19 (-1.27%)

Crude Oil 41.00, +0.03 (+0.07%)

Gold 1,953.80 +3.90 (+0.20%)

10-Yr Bond 0.6840, -0.0030 (-0.44%)

Asian market today

Nikkei:Holiday (Monday and Tuesday)

Dow future:around 27,580 (-77 Dow spot)

Economic indicators today

GMT 12:45 (EU) ECB President Ms.Lagarde remark

23(Wed)RBNZ policy rate