Introduction

As I introduced in the first article, I explained that CCI’s most powerful features are quick and sensitive. Divergence of CCI also occurs earlier than one of RSI. In this article, I would like to take a deeper look at divergence of CCI.

Divergence of CCI is quick and sensitive

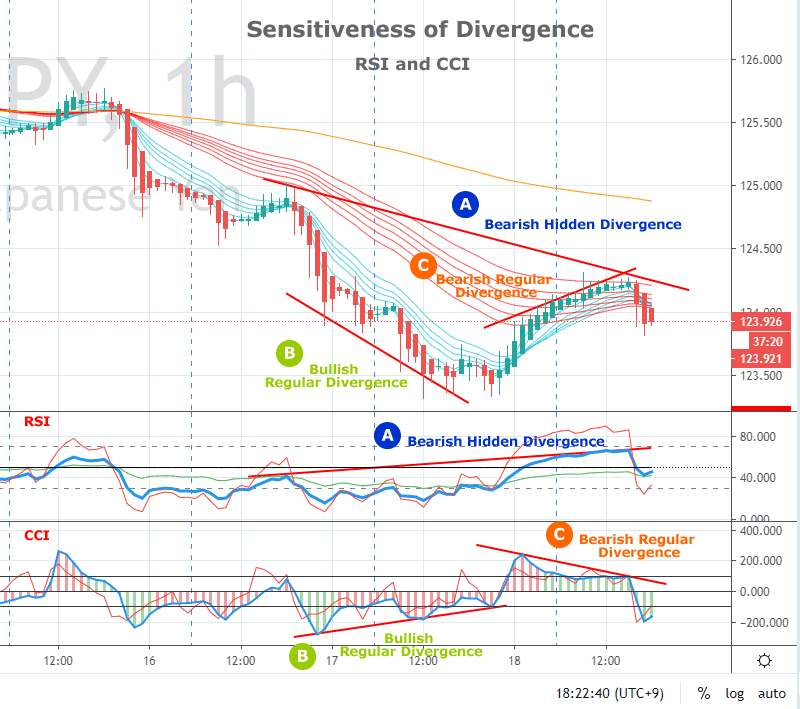

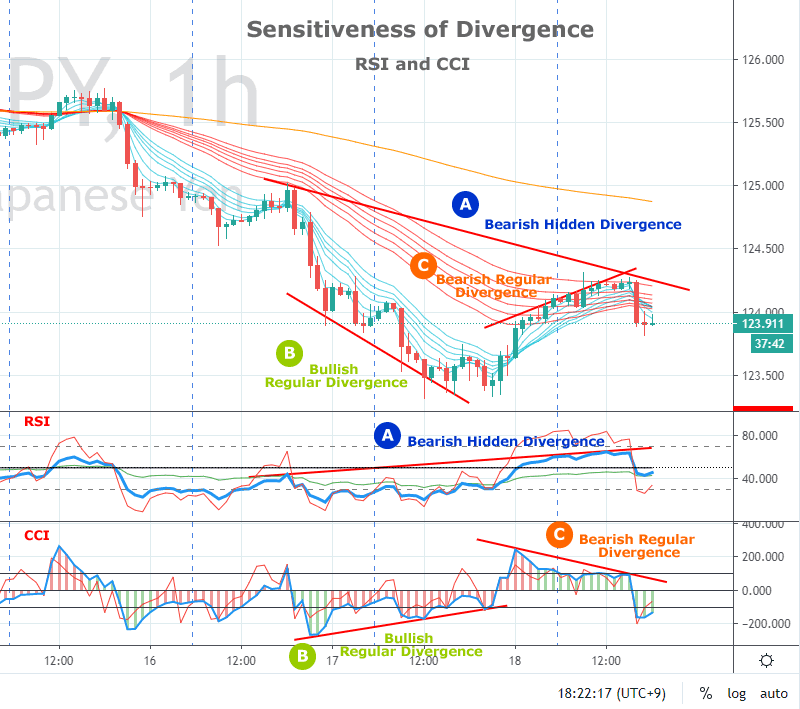

The chart below is an hourly chart of EURJPY. The blue line on the RSI and the blue line on the CCI are both periods “14”.

Circle A means (bearish) Hidden Divergence

Circle B means (Bullish) Normal Divergence

Circle C means (bearish) normal divergence

We can see that while the RSI captures only “Circle A: (bearish) hidden divergence”, the CCI captures both “Circle B: (bullish) regular divergence” and “Circle C: (bearish) regular divergence”.

Divergence of CCI and Heikin-ashi

In addition, if we use the Heikin-ashi, there is a possibility that we can make a more accurate entry by combining it with the divergence of CCI. The chart below using Heikin-ashi is just the same timing of chart as above.