Trade Idea

Good morning. Tokyo market is closed today as well as yesterday.

Due to the consecutive holidays in Japan, JPY is appreciating. Foreign exchange market was in a typical risk-off situation, with JPY and USD being bought and the cross JPY being sold. In the European market, as for USDJPY, JPY buying won and tried to break below 104.00, and in the US market, USD buying won due to the weakening of US stocks and returned to around 104.80.

EURUSD temporarily fell to 1.173 in the US market and closed in the US market around 1.176. The cross JPY has fallen sharply, EURJPY has fallen to 122.5 temporally, and AUDJPY has fallen to 75.25 temporally.

EURUSD is likely to break support for 1.17. The cross JPY has plummeted, but it will be reversed with reopening of the Tokyo market after tomorrow, or it will be a wait-and-see. Anyway, when the cross JPY goes down (Currency strength “JPY > USD > other currencies” in risk-off situation), it’s really quick!!

EURUSD H1

(Please click the chart to enlarge.)

EURJPY H1

(Please click the chart to enlarge.)

AUDJPY H1

(Please click the chart to enlarge.)

Market Environment

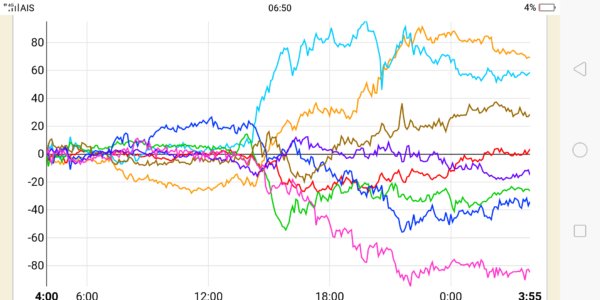

Yesterday’s currency strength

![]()

US market yesterday

Dow30: 27,148 -509.72 -1.84%

NASDAQ: 10,779 -14.48 -0.13%

S&P 500: 3,281 -38.41 -1.16%

10-Yr Bond: 6.71↓

Crude Oil: 39.76↑

Gold: 1,916.75↓

Asian market today

Nikkei:Holiday

Dow future:around 27,024 (-123 Dow spot)

Economic indicators today

GMT 07:30 (UK) BOE President Mr. Bailey remark

GMT 14:30 (US) FRB chaiman Mr. Powell remark

23(Wed)RBNZ policy interest