Trade Idea

Good morning. Tokyo market is reopened today after consecutive holidays.

Yesterday, US stocks rebounded, but risk-off USD buying became dominant. USDJPY temporarily recovered 105.00 and finished US market at 104.9. EURUSD temporary broke big milestone of 1.17 and ended near 1.171. Meanwhile, GBPUSD was volatile over +/- 100 pips.

EURUSD is once again below 1.17 in current Tokyo market now. The current level is around Fibonacci retracement of 0.382, which has risen since June. I would like to wait for EURUSD reversal while watching when US stocks, Gold, and Bitcoin will revert.

EURUSD H1

(Please click the chart to enlarge.)

USDJPY H1

(Please click the chart to enlarge.)

Market Environment

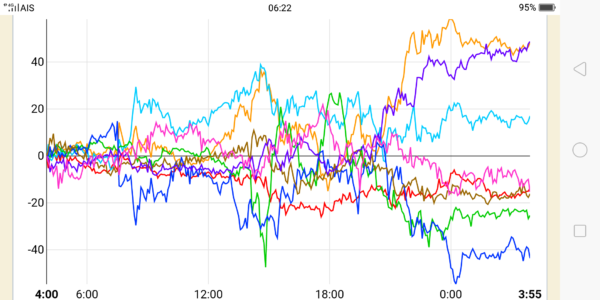

Yesterday’s currency strength

![]()

US market yesterday

Dow30: 27288.18(+140.48, +0.52%)

S&P500: 3315.57(+34.51, +1.05%)

Nasdaq: 10963.64(+184.84, +1.71%)

10-Yr bond: 0.674↑

WTI Oil: 39.66 ↓

Gold: 1,907 ↓

Asian market today

Nikkei: 23,246~ (-114)

CME Dow future: 27,241~(-47 Dow)

Economic indicators today

GMT 11:00 (NZ) RBNZ policy interest

GMT 16:30 (GE) PMI – Mfg, Non-Mfg

GMT 17:00 (EU) PMI – Mfg, Non-Mfg

GMT 17:30 (UK) PMI – Mfg, Non-Mfg

GMT 22:45 (US) PMI – Mfg, Non-Mfg

GMT 23:00 (US) FRB chaiman Mr. Powell remark