Introduction

It is September from today.

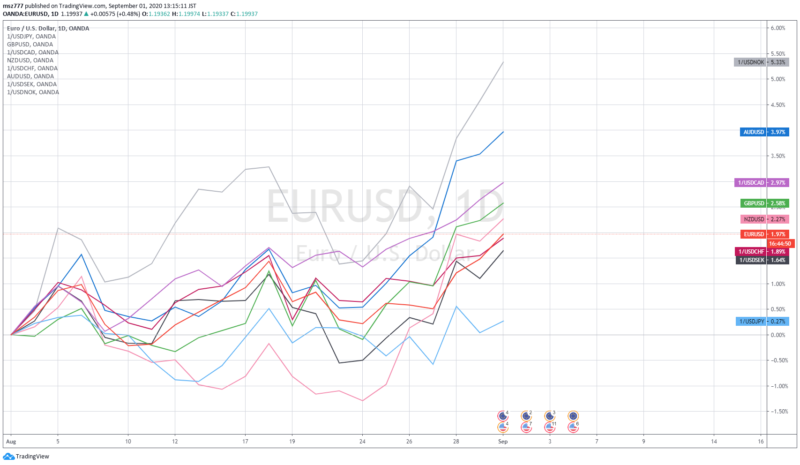

In this article, I would like to make a relative comparison of currency strengths for the G10 currencies, which is a group of major currencies, by YTD (for the beginning of this year) and by MTD (for the month of August last month).

Currency strength analysis of G10 currencies (YTD: 2020)

The strength and weakness of the currency seen from the beginning of the year 2020 from the strongest order is as follows.

- SEK (black)

- CHF (brown)

- EUR (red)

- AUD (blue)

- JPY (light blue)

- NOK (gray)

- GBP (green)

- USD (Since it is a relative comparison target, it is not displayed.)

- NZD (pink)

- CAD (purple)

When analyzing currency vulnerabilities, there is a method of using the categories of currencies such as “Current account surplus or deficit”, “Non-resource country or resource country”, and “G10 currency or other currency”.

Since we are only targeting G10 currencies in this article, there are two classification axes: “whether the current account is surplus or deficit,” and “whether it is a non-resource country or a resource country.” It can be divided into the following 4 groups. Group 1 is the most vulnerable currency and Group 4 is the most vulnerable currency. (However, all currencies of the G10 currency are stronger than the currencies of other developing countries.)

| Current account | Resource | Currencies | |

| Group. 1 | Surplus | Non-resource country | JPY, EUR, CHF, SEK |

| Group. 2 | Deficit | Non-resource country | GBP |

| Group. 3 | Surplus | Resource country | AUD, NOK |

| Group. 4 | Deficit | Resource country | NZD, CAD |

From the beginning of the year 2020, we can see that the order of currency strength is almost same order of the four groups. However, we can see that AUD has outstanding performance.

Since May in this year, USD has depreciated against all other major currencies. Most of the major currencies have risen against the USD since the beginning of the year following the volatility of the COVID-19 Pandemic, but the NZD and CAD have returned to almost the same level as at the beginning of this year.

Currency strength analysis of G10 currencies (MTD: 2020-Aug)

The strength and weakness of the currency seen from the beginning of August 2020 from the strongest order is as follows.

- NOK (gray)

- AUD (blue)

- CAD (purple)

- GBP (green)

- NZD (pink)

- EUR (red)

- CHF (brown)

- SEK (black)

- JPY (light blue)

To compare with the YTD analysis mentioned above, NOK and the CAD showed strong performance in this month, mainly due to rising crude oil price. As for NOK, it was the weakest currency among the G10 currencies in pandemic turbulence, due to the crude oil price crash. After that the buyback of NOK from oversold is continuing.

The relative weakness of the CHF, JPY, and the SEK suggest that risk-on mood continued in August. EUR was the strongest currency in Group.1.

It can be said that USD has generally weakened against all major currencies, while AUD has remained strong since the beginning of this year.

AUD is likely to remain the fundamentally strongest currency for a while. The reasons are.

- The Australian economy’s trade surplus and current account surplus are expected to remain solid in the future as the Chinese economy recovers.

- RBA (Australian central bank) has the highest policy interest rate of 0.25% among the advanced economies