Introduction

This is the 4th article about divergence trade strategy.

In the articles I have written so far about hidden divergence, how to avoid fake of divergence, and how to predict and wait divergence.

However, there are still possibilities that the price goes opposite, and loss increase after your entry with judgement of high possibility to win.

In that case, if we judge the scenario was wrong, we have to make loss cut as suitable level, and prepare for next entry.

How to cut loss when you enter due to occurrence of divergence

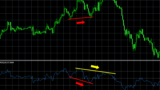

The chart below is an example of a short (sell) entry aimed at trend reversal with the occurrence of regular divergence.

After confirming the occurrence of regular divergence, the next bar became the engulfing bearish candle. So, suppose we make a short (sell) entry at the next bar’s open price (blue dotted line).

In this example chart, the entry level has just become resistance line, and after four bars have passed, it has gone well, price fell, and profit increased.

However, if we didn’t take a profit, unfortunately, the reversal movement started, and unrealized loss increased.

So, in this case, how should we set loss cut line?

The loss cut line in this case is where the price exceeds previous high. (Red dotted line).

If price exceed the previous high, it is highly likely that the divergence itself has been denied, that is, the scenario that we drew has been denied. Therefore, it does not make sense to hold the positions anymore.