Forex Broker Comparison

Forex Broker Comparison

XM vs HotForex – Forex brokers comparison

Forex Broker Comparison

Forex Broker Comparison  Forex Broker Comparison

Forex Broker Comparison  Forex Broker Comparison

Forex Broker Comparison  Forex Broker Comparison

Forex Broker Comparison  Forex Broker Comparison

Forex Broker Comparison  Forex Broker Comparison

Forex Broker Comparison  Forex Broker Comparison

Forex Broker Comparison  Forex Broker Comparison

Forex Broker Comparison  Forex Broker Comparison

Forex Broker Comparison  Forex Broker Comparison

Forex Broker Comparison  Forex Broker Comparison

Forex Broker Comparison  Forex Broker Comparison

Forex Broker Comparison  Forex Broker Comparison

Forex Broker Comparison  Forex Broker Comparison

Forex Broker Comparison  Forex Broker Comparison

Forex Broker Comparison  Forex Broker Comparison

Forex Broker Comparison  Forex Broker Comparison

Forex Broker Comparison  Forex Broker Comparison

Forex Broker Comparison  Resources

Resources  Resources

Resources  Resources

Resources  Resources

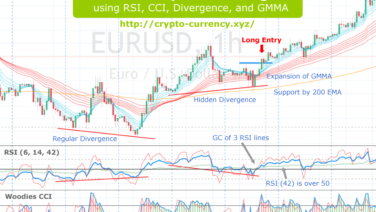

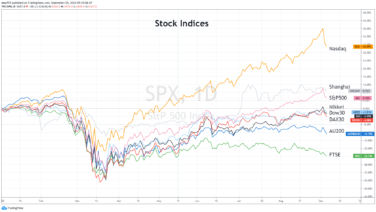

Resources  Trade Idea

Trade Idea  Resources

Resources  Resources

Resources  Trade Idea

Trade Idea  Resources

Resources  Resources

Resources